A cryptocurrency exchange is similar to a stock exchange, but with a focus on cryptocurrency tokens rather than stock trades. Essentially, a crypto exchange offers a platform whereby customers looking to buy and sell cryptocurrency assets can exchange the digital tokens in values based on current market prices. 3 different types of Cryptocurrency Exchanges are

Also known as a CEX, centralized cryptocurrency exchanges are similar to traditional stock exchanges. The buyers and sellers come together and the exchange plays the role of a middle-man. In the crypto-world, “centralized” means to trust somebody else to handle your money. Among different types of cryptocurrency exchanges, one of the main issues with centralized cryptocurrency exchanges is their vulnerability to hacks.

A decentralized exchange – also referred to as a DEX – acts as an alternative to a traditional, centralized exchange. This type of cryptocurrency platform does not depend on a company or a service to control the assets of a customer. Instead, the trades or transactions are controlled by an automated process without any central presence. These trades are considered peer-to-peer or customer-to-customer.

A hybrid cryptocurrency exchange is a combination – as the name implies – of both centralized and decentralized exchanges. Taking the best from platform concepts, a hybrid exchange offers the trustless nature combined with the low latency and fast transaction speeds of centralized platforms. Like decentralised exchanges, a hybrid makes use of smart contracts to ensure that there is no central figure imposing on the integrity of the trade. Basically, this reduces security risks and puts the safety of a customer’s assets onto a blockchain rather than relying on a company.

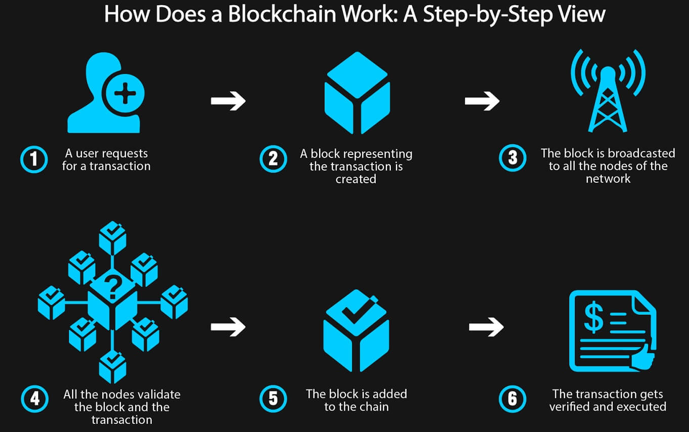

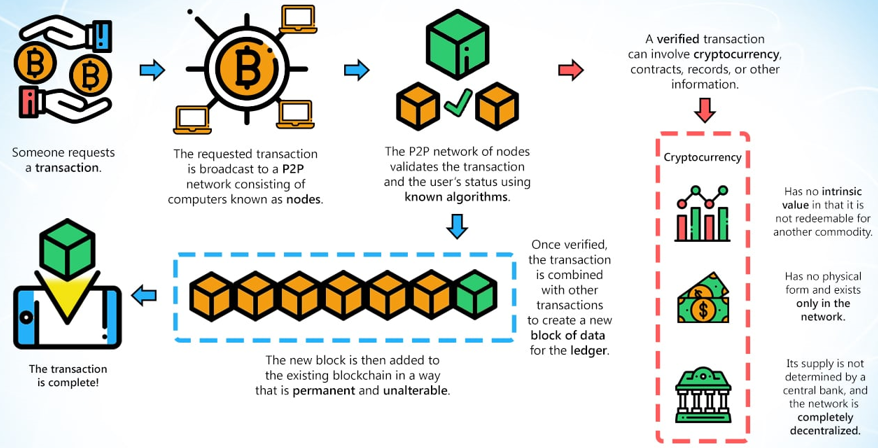

The blockchain is a chain of blocks where each block contains data of value without any central supervision. It is cryptographically secure and immutable.

A blockchain is a digitized, decentralized, public ledger of all cryptocurrency transactions. Constantly growing as ‘completed’ blocks (the most recent transactions) are recorded and added to it in chronological order, it allows market participants to keep track of digital currency transactions without central recordkeeping. Each node (a computer connected to the network) gets a copy of the blockchain, which is downloaded automatically.

Originally developed as the accounting method for the virtual currency Bitcoin, blockchains – which use what's known as distributed ledger technology (DLT) – are appearing in a variety of commercial applications today. Currently, the technology is primarily used to verify transactions, within digital currencies though it is possible to digitize, code and insert practically any document into the blockchain. Doing so creates an indelible record that cannot be changed; furthermore, the record’s authenticity can be verified by the entire community using the blockchain instead of a single centralized authority.

Blockchain's removal of almost all human involvement in processing is particularly beneficial in cross-border trades, which usually take much longer because of time-zone issues and the fact that all parties must confirm payment processing. Blockchain systems can set up smart contracts or payments triggered when certain conditions are met. The blockchain cotton transaction mentioned above, for example, use of a smart contract that automatically made partial payments when the cotton shipment reached specific geographic milestones.

Bitcoin is a form of digital currency, created and held electronically. No one controls it. Bitcoins aren’t printed, like dollars or euros – they’re produced by people, and increasingly businesses, running computers all around the world, using software that solves mathematical problems. Bitcoins come from a mining process, but not the conventional physical mine where silver, gold, copper and nickel are plucked from the earth and sent to the mint. This mining process releases bitcoin into the marketplace when the miners solve a mathematical puzzle or unravel a complex code.

Bitcoin is rapidly gaining acceptance in the virtual marketplace and shows signs of purchase power in ever more mainstream businesses.Just like stocks and bonds, users can choose to hold or sell bitcoin at will.

on all Australian Exchanges

Bitcoin Halving is the event where the number of generated Bitcoin rewards per block will be halved (divided by 2). The total number of Bitcoin mined by miners per block will reduce from 6.25 to 3.125 BTC in the next bitcoin halving. The number of bitcoin found per block will become more scarce and this halving reward ensures that bitcoin total supply will reach 21 million.

Buy your favourite crypto via reputed Australian Exchange

CoinSpot is one of Australia’s leading exchanges with the largest selection of blockchain assets of any Australian exchange.

REVIEW COINSPOT

IR is a Sydney based digital Currency exchange, providing a secure and trustworthy place for customers to buy and sell Bitcoin and Ethereum.

REVIEW INDEPENDENT RESERVE

Digital Surge is a Bitcoin exchange based out of Brisbane. Their platform has been built to help new investors easily and securely buy, trade or pay their bills with bitcoin.

REVIEW DIGITAL SURGE

Cointree is a Melbourne based digital Currency exchange, providing a secure and trustworthy place for customers to buy and sell Bitcoin and other 100+ coins.

REVIEW COINTREEOn Mar 18, 2019, Australia’s federal government announced a boost of AU $100,000 and its plan to develop a national blockchain roadmap.Here is a list of some of Australia blockchain startups to watch out for.

Australia’s blockchain darling, Power Ledger was one of the first local projects to gain global recognition after a series of prominent partnerships and pitch comp wins boosted it to one of the top 100 cryptocurrencies. Power Ledger is a fast growing tech startup that has developed a world-first blockchain enabled energy trading platform to make energy markets more efficient.

BUY POWER LEDGER VIA AUS EXCHANGEHeadquartered in Melbourne, CanYa aims to link services with persons with needs. They wish to provide a completely decentralised peer-to-peer marketplace that will allow users world-wide to connect services to different people. The four core parts of the ecosystem include the wallet, the peer-to-peer services, the CanYa Coins and the global marketplace which are all connected to provide a marketplace backed by blockchain.

BUY CANYA VIA AUS EXCHANGEPlayChip is a blockchain based online sports betting platform and fantasy sports ecosystem. The PlayChip is set to become the universal token for sports betting, gaming, fantasy sports, and eSports. The PlayChip will form the foundation to facilitate the decentralisation of our existing partner platforms and allow sports fans to connect, compete and collect, irrespective of their location. The PlayChip is an ERC20 token.

BUY PLAYCHIP VIA AUS EXCHANGE